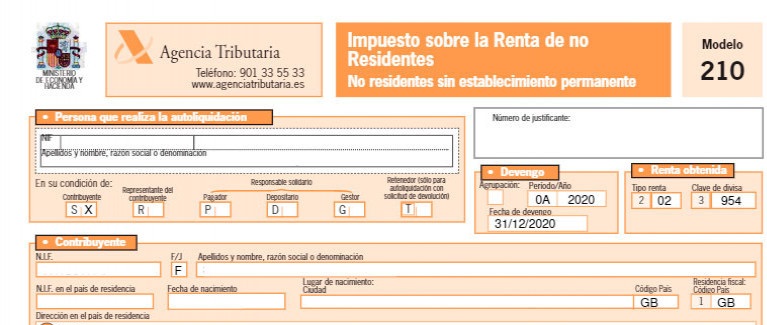

Every property owner who is not a resident of Spain is required to file at least one annual tax return (Modelo 210), in which they must declare the imputed or accrued income from their property. Form 210 applies to all properties, regardless of whether they are empty or occupied by the owner.

If the property is rented out, non-resident owners must also submit a quarterly tax return (via Modelo 210) to report the rental income received in the previous quarter.

If the property is partially rented during the tax year, non-resident taxpayers must file both an annual and a quarterly tax return.

Self-assessment

The non-resident tax return, Form 210 (Modelo 210), is a self-assessment declaration. Therefore, non-resident taxpayers are responsible for filling in the return and paying the tax themselves. The tax authorities do not send reminders.

When is the deadline to file the non-resident tax return?

For non-rented properties, the deadline to file the non-resident tax return is December 31 of the year following the tax year. The deadline for the non-resident tax return (Form 210) for 2023 is December 31, 2024. However, if you want to set up direct debit payment, the deadline is December 23, 2024.

For rented properties, non-resident taxpayers must declare rental income quarterly during the first 20 days of April, July, October, and January for the previous quarter. For example, rental income earned in the second quarter of 2024 (April–June 2024) must be declared within the first 20 days of July 2024.

When will taxes be charged to my account?

If you file the annual tax return and choose direct debit as the payment method, the Spanish Tax Agency (Agencia Tributaria) will charge the tax to your Spanish bank account on December 31.

If you want to pay earlier, you can transfer funds to IberianTax, and we will arrange tax payment simultaneously with filing your tax return with the Tax Agency.

How is the non-resident tax calculated?

The non-resident tax on non-rented property is calculated as follows:

- First, the imputed income on non-rented property is determined by applying 2% or 1.1% to the cadastral value of the property (Valor Catastral). As a rule, the 2% rate applies if there has been no general cadastral review in the municipality during the past 10 tax years.

- This income is deemed to arise for legal purposes, regardless of whether the property is empty or used for personal purposes.

- The imputed income is then divided proportionally among the owners.

- The tax liability is calculated by multiplying the imputed income by the applicable tax rate.

- The tax rate is 24% (or 19% for residents of the EU, Norway, Iceland, and Liechtenstein).

- Important note: Due to Brexit, starting with the 2021 tax year, the tax rate for U.K. residents increased from 19% to 24%.

Formula for calculation:

Cadastral value × Imputed rate (2% or 1.1%) × Tax rate (24% or 19%).

How to file the non-resident tax return online?

You can use our simple online service, which requires no prior tax knowledge and allows you to file and pay your taxes online from your home country. You can also submit your tax return directly to the Agencia Tributaria online if you have a Spanish digital certificate and are confident dealing with the Spanish tax system.

What happens if I miss the non-resident tax return deadline?

If you fail to file the tax return on time, you may be fined at least 50% of the tax owed, in addition to the original tax debt. You may also have to pay late payment interest.

You can avoid a penalty if you voluntarily file your return before being contacted by the Spanish tax authorities. If you pay your overdue tax between 1 and 12 months late, you will face a surcharge of 1% to 12% of the amount due.

If you pay the tax more than 12 months late, you will be subject to a 15% surcharge on the tax owed, plus late payment interest.

For example, if you file your non-resident tax return for 2022 in May 2024 (as a late return), you will have to pay a 5% surcharge.

This notice is sent directly by the tax office, which usually issues two letters. The first is called “Propuesta de Liquidación,” where the Agencia Tributaria informs you of the surcharge, and one or two months later a second letter, “Liquidación,” arrives, which includes the payment slip allowing you to pay the surcharge or fine.