Residence permit in Spain (Residencia), as well as Spain itself, consistently rank among the most attractive choices for foreigners. It is important to consider the main advantages and disadvantages of obtaining residency in Spain before reviewing all the available options. Advantages: Disadvantages: Types of Residence …

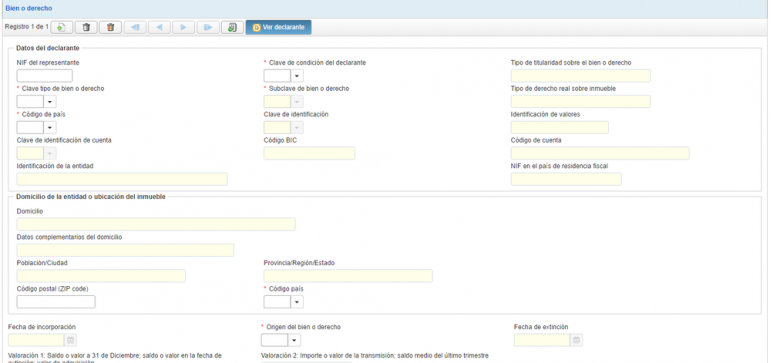

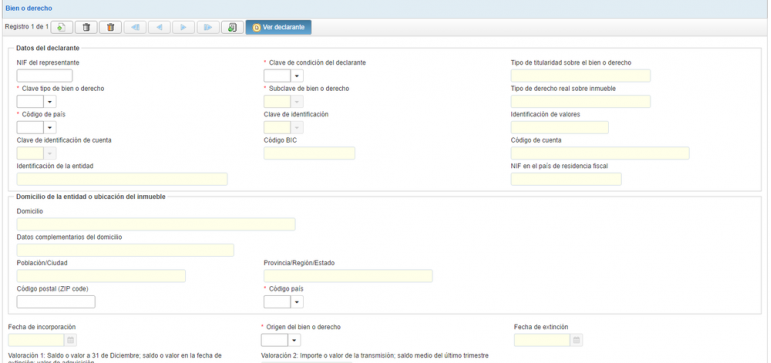

Tax Return in Spain — Form 720 (Modelo 720) in 2025

Modelo 720, or Form 720, is an online tax declaration that must be submitted annually by Spanish tax residents, including Russian citizens, before April 1 each year. In 2025, this declaration must already be filed. Previously we wrote about taxes for digital nomads; today we …

Taxes for Digital Nomads in Spain

A digital nomad is a person who uses the internet as the main resource for work or selling knowledge to other people or companies. This is someone who works remotely and leads a nomadic lifestyle while traveling around the world. In this article, we examine …

Student Residence Permit in Turkey in 2025

Previously, foreigners wishing to reside in Turkey for an extended period often opted for a tourist residence permit. However, the situation has changed, and obtaining a residence permit through this method has become significantly more difficult. We still offer full support for this type of …

How can a foreigner open a bank account in Spain in person and remotely in 2025?

Opening a bank account in Spain as a foreigner can be challenging if you are a tourist. However, if you plan to legalize your stay by applying for a residence permit (of which there are over 10 types in Spain), once you have your residency …

What is the difference between NIE, TIE, NIF, CIF, and DNI in Spain?

In Spain, there is often confusion between the identification documents DNI, NIF, NIE, TIE, and CIF. While all of them serve to identify individuals or legal entities, each has its own specific purpose. Below is an explanation of the key differences: DNI (Documento Nacional de …

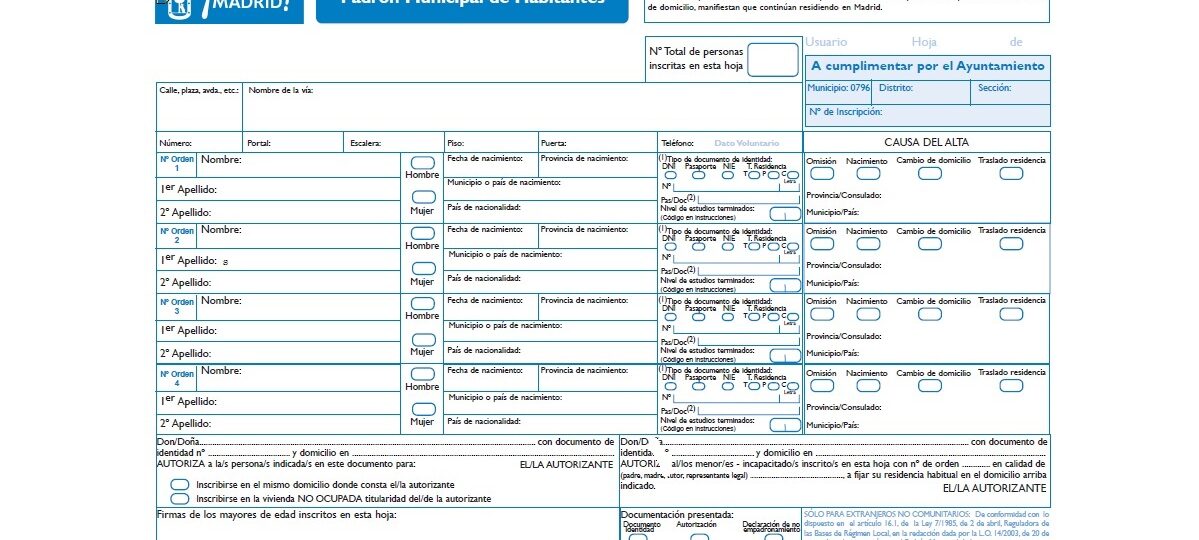

Registration (residency) in Spain — Padrón, Empadronamiento

What is registration (empadronamiento) in Spain? In Spain, everyone residing in the country is required to register at their place of residence. This registration, known as Padrón or empadronamiento, is necessary for the Spanish authorities to maintain population records and verify living conditions. Why is …

Full-Service Assistance in Obtaining Spanish Residency Permits

More and more people are considering moving to Europe—whether for a better climate, quality education for children, work opportunities, or simply a safer life. In practice, however, obtaining a residence permit (residencia) in most EU countries turns into a long, costly, and often stressful process. …

Turnkey Registration of Sole Proprietorship (SP) or Company in Montenegro

Entrepreneurs looking to expand or relocate their business to the European region often choose to register as a sole proprietor or company in Montenegro. This is due to favorable tax conditions and the simplicity of registration compared to neighboring countries. Moreover, establishing a company provides …

VAT in Georgia in 2025

Standard VAT in GeorgiaThe standard value-added tax (VAT) rate in Georgia is 18%. Mandatory Registration Companies are required to register as VAT payers if their revenue from taxable operations exceeds 100,000 GEL over any consecutive 12-month period. Voluntary Registration Organizations may also register voluntarily to …