Modelo 720, or Form 720, is an online tax declaration that must be submitted annually by Spanish tax residents, including Russian citizens, before April 1 each year. In 2025, this declaration must already be filed. Previously we wrote about taxes for digital nomads; today we will focus on specific tax reporting forms in Spain.

The declaration is submitted in addition to income tax and wealth tax returns. The general rule is that you must declare assets you own outside Spain if the total value of foreign assets in any one category exceeds €50,000.

Long-term Spanish residents are familiar with Form 720, but new residents may not know what exactly needs to be done. Late or incorrect filing results in penalties (though they are now less severe than before), so it is important to get everything right. The annual deadline, as always, is March 31.

If you were a Spanish tax resident in 2023, you are required to file Modelo 720 (always online), declaring foreign assets worth over €50,000. This is not a tax return as such; it must be submitted in addition to income and wealth tax declarations.

Apart from confirming what needs to be declared this year, it is also a good time to consider whether your assets are held in the most tax-efficient structures for Spain. For example, if you have investments designed for U.K. tax efficiency, you may be paying more tax in Spain than necessary.

Tax Residency Rules

You are considered a Spanish tax resident if any of the following apply:

- You spend more than 183 days in Spain in a calendar year, or

- Your “center of economic interests” is in Spain, or

- Your “center of vital interests” is in Spain (e.g., your spouse lives there).

There is no concept of a split tax year: you are either a resident or a non-resident for the entire tax year.

Form 720 — General Rules

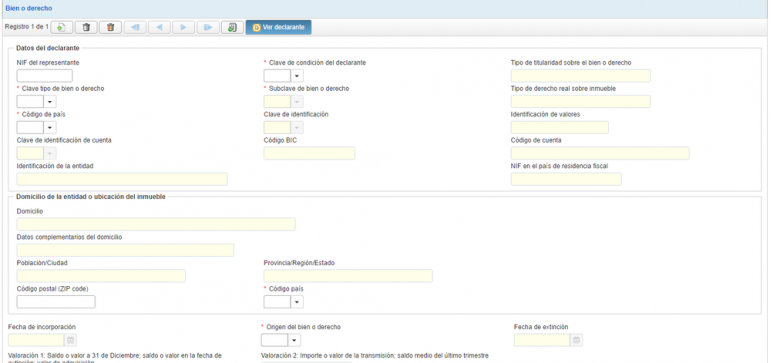

You must declare all assets in a given category if their total value exceeds €50,000. This rule applies only to assets located outside Spain. The three reporting categories are:

- Accounts in financial institutions (banks)

- Investments

- Real estate

In the case of joint ownership, each owner must declare the full value (even if your share is below €50,000) and indicate the percentage of ownership.

Generally, you must declare assets if you are the owner, settlor of a trust, beneficial owner, authorized signatory, or otherwise have disposal rights. This includes assets owned by a company, trust, or nominee.

Assets are valued under wealth tax rules as of December 31 each year. For bank accounts, you must also declare the average balance over the last three months of the year. Investments held in other currencies must be converted into euros using the official exchange rate.

Your Tax Declaration in Spain for 2025

In the 2024 return, you must declare the assets you owned at the end of 2024.

If you have already filed Form 720 in previous years, you must submit it again only if:

- The value of an existing asset increased by more than €20,000, or

- You sold an asset/closed an account, or

- You acquired new assets.

Form 720 — Penalties

Since the introduction of Modelo 720 in 2012, penalties for late, incomplete, or incorrect filing were disproportionately harsh. However, following a 2022 European Court ruling, Spain finally amended the penalty regime, and the form now falls under the general penalty framework of Spanish tax law.

- The fixed fine is €20 per piece/set of information that should have been included.

- The minimum fine is €300, and the maximum is €20,000.

These fines (including minimum and maximum limits) are reduced by 50% if Form 720 is filed after the deadline but before notification of non-compliance from the Spanish tax authorities.

However, note that fines are doubled if the undeclared assets or rights are located outside the European Union.

A four-year statute of limitations now also applies to Modelo 720, meaning the tax authorities cannot impose penalties for more than the last four tax years.