A digital nomad is a person who uses the internet as the main resource for work or selling knowledge to other people or companies. This is someone who works remotely and leads a nomadic lifestyle while traveling around the world. In this article, we examine the taxes for digital nomads in Spain.

Key Characteristics of a Digital Nomad

- Freedom of movement: By working online, a digital nomad can be anywhere in the world and turn any place into an office.

- Variety of business models: Freelancers, entrepreneurs, and employees can all be digital nomads.

- Unique lifestyle: The work and life of a digital nomad differ from traditional models. Digital nomads can be divided into:

- Freelancer: Works independently and provides online services (e.g., writing, invoicing).

- Entrepreneur: Typically generates passive income (e.g., online advertising or info products).

- Remote employee: Works for a company remotely, receiving a salary but organizing time independently.

Examples of professions suitable for digital nomads:

- Programmer

- Online consultant or coach

- Designer

- Photographer

- Copywriter and web editor

- Translator

- Online store owner

- Marketplace worker

In fact, countless professions can fall under the digital nomad lifestyle.

Tax Residency of Digital Nomads

Even if you work remotely and travel, you still need to pay taxes. Your tax residency depends on where you spend most of your time, where your family lives, and in which country you generate income.

One of the main advantages of Spain’s new visa regime for digital nomads is favorable tax treatment. The fixed tax rate is significantly lower than the regular one, and there are exemptions from several other taxes.

A foreigner is considered a tax resident in Spain if at least one of the following applies:

- Staying in Spain for more than 183 days in a year.

- Having financial interests concentrated in Spain.

- Having a spouse or children living in Spain.

As tax residents, nomads must:

- Declare and pay personal income tax (IRPF) on worldwide income at progressive rates up to 50%.

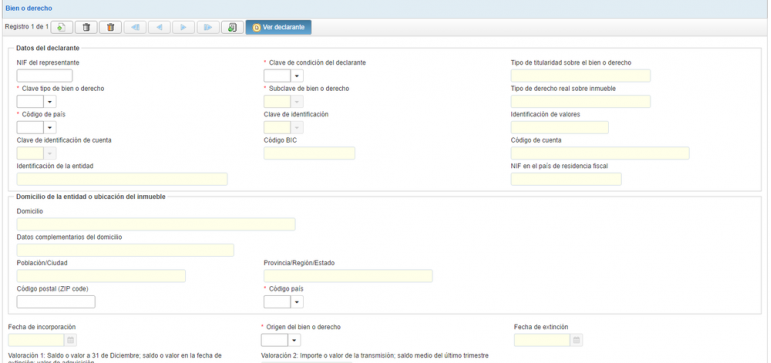

- Declare assets using Form 720.

- Fulfill other obligations established by law.

However, holders of the Digital Nomad Visa may qualify as tax non-residents, meaning the obligations above are less strict.

The Beckham Law for Digital Nomads

The new Startup Law in Spain expanded the use of the so-called Beckham Law. This special regime allows an individual to not be treated as a tax resident, even if staying in Spain for more than 183 days a year.

The main condition: the applicant must not have been a Spanish tax resident in the past 5 years, and the current stay in Spain must be work-related.

Once approved, one can enjoy non-resident tax status for 5 years (plus the application year). Afterwards, there is an automatic transition to the general tax regime (resident).

Tax Rates for Digital Nomads in Spain

Digital nomads in Spain pay a fixed 24% tax rate on income up to €600,000, and 47% on income exceeding this threshold.

For income above €600,000, the flat rate rises to 48%.

Capital gains tax also applies (e.g., on sale of shares, real estate, interest, or securities):

- 19% up to €6,000

- 21% from €6,001 to €50,000

- 23% from €50,001 to €200,000

- 27% from €200,001 to €300,000

- 28% above €300,001

Other benefits for digital nomads under this regime:

- Exemption from filing Form 720.

- Exemption from wealth tax.

- Reduced capital gains tax (19%–28%).

Double Taxation for Digital Nomads

Digital nomads work remotely from Spain, meaning their income usually comes from abroad. Double taxation is resolved through Double Taxation Treaties (DTTs), which define tax residency and prevent double taxation.

Summary: Taxes for Digital Nomads

The updated Beckham Law makes it easier for foreigners to pay income tax at a reduced rate of 24% on up to €600,000 per year, while foreign-sourced income is not taxed in Spain.

In 2023, the average salary in Spain was €30,000, and only 10% of workers earned above €45,000. Applicants for the digital nomad tax regime usually earn around €60,000 annually, placing them among the top 10% of earners.

The law was updated in December 2022 by Law 28/2022 to stimulate the startup ecosystem. Key changes include:

- Reducing the non-residency requirement before moving to Spain from 10 years to 5 years.

- Extending eligibility to:

- Digital nomads working remotely in Spain.

- Startup directors (with up to 25% ownership).

- Entrepreneurs under the Spanish Entrepreneurship Support Law.

- Highly qualified professionals in startups or research, if 40%+ of income comes from such work.

- Treating all income earned in Spain as business activity.

- Exemption from certain in-kind income taxation.

These changes strengthen the regime and make Spain more attractive for international professionals.